No credit history Examine. Paycheck advance apps may be fairly very easy to qualify for, and so they don’t need a credit score Verify.

Sure, You can utilize your card to purchase each day buys where ever the Visa emblem is displayed. Your HSBC debit card is accepted at A large number of shops in Egypt and more than 28 million retail outlets worldwide.

Advance amounts (30%): We prioritized paycheck advance apps which have a wider range of advance quantities. For example, an app gained a more favorable rating if its most advance volume is $250 or larger.

Small-term loans will not be meant to be long-expression fiscal options. Customers with credit history troubles need to request credit rating counseling. Only one payday advance is often for two to 4 months. However, borrowers normally use these financial loans over a duration of months, which may be high priced.

For anyone who is registered for on-line banking, it is possible to request a debit card or ask for a substitution online. You can even ask for a debit card utilizing the HSBC Cell Banking application utilizing the "Send us a message" characteristic.

A personal bank loan might not be your to start with believed if you need a small volume of hard cash. But, based on the lender, you may get a little particular personal loan for as tiny as $five hundred.⁵

Your ATM withdrawal Restrict differs from bank to bank and the sort of account you have got normally decide the amount funds you will take out in the ATM each day.

Particular loan: In many scenarios, taking out a private mortgage with the lender is more inexpensive than obtaining a hard cash advance simply because they have superior borrowing phrases.

For those who don’t have ample cash in your account to protect your advance in full, Dave will take a partial payment as an alternative. In addition it doesn’t charge a late price. Although a regular monthly subscription is needed, it’s only $one per month.

You’ll see that all lenders have their techniques, schedules, and conditions for mortgage repayment. Be sure to read through your loan agreement and make sure that you realize the phrases contained within it.

They’re simple to use and can cause overspending. Some apps also report late payments on the credit get more info rating bureaus.

Credit history cards are useful equipment when paying for an unpredicted cost. If you have a superb credit rating, you would possibly qualify for just a card with a 0% introductory desire rate. Otherwise, you may keep away from shelling out curiosity by shelling out off your balance in total just about every statement interval.

When you don’t have the most beneficial credit score, don’t be concerned. Numerous payday lenders who provide debit card financial loans on the net have versatile prerequisites. Many of them won’t even look at your credit rating score and can approve you according to your work position and earnings.

Chronically taking paycheck advances or payday financial loans is an uncomplicated way to get stuck in a cycle of personal debt. You might think you only need somewhat dollars until eventually the subsequent payday, but what takes place when it’s time to repay? You may end up getting One more financial loan to receive by. It’s just not sustainable.

Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Alisan Porter Then & Now!

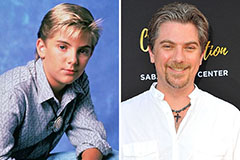

Alisan Porter Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!